As Canada heads into 2025, its economy has ridden a 4-year wave unlike anything it has ever seen. From the cascading fall during COVID to the rapid increase in talent demand and spending to  rising inflation and stalling consumer demand, the roller coaster has kept executives and business owners on the edge of their seats as they look for a sense of calm, stable footing to build and grow their business.

rising inflation and stalling consumer demand, the roller coaster has kept executives and business owners on the edge of their seats as they look for a sense of calm, stable footing to build and grow their business.

Historically, that calm, stable footing was predicated on a workforce with a strong skills alignment to the market. Employers could seek out top talent with patience, care, and retention was almost guaranteed. But years ago, that already changed. In 2001, “The War for Talent” by Ed Michaels et al. predicted a near-term future where the critical skills needed for a rapidly advancing technology economy would outpace the supply. Quickly followed by the mass adoption of the personal computer, then the dawn of the internet, advancing mobile technology, and finally, the public adoption of AI meant that technology was no longer just for organizations…it was in the hands of the public, and companies needed to keep up. They needed skills to advance their organization quickly and effectively or risk stagnation. They needed talent strategies to retain and engage talent or risk losing brilliant minds to the competition and other markets.

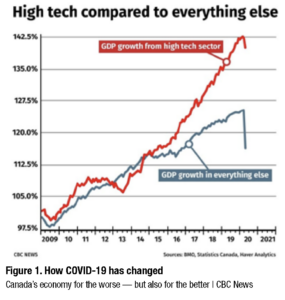

In some geographies worldwide, government and educational institutions adapted and created training programs to enhance those skills. They reformed education to emphasize the need to develop future skills versus those that existed historically. Like many, Canada adopted some of those advancements, and its reputation as a global leader in technology expanded. Advanced mobile pay technology, fintech, AI, carbon capture, and aviation were just some of the advanced fields where Canada was making its mark. High-tech economic growth increased YoY from 2009 until 2020, while the rest of the economy continued its steady increase during that same period.

So, what happened after 2020? Where did all the talent go?

Even before COVID disrupted the ways of working, Canada’s gig economy grew to the point where roughly 10% of the total workforce exited the traditional labour market to hone their skills and generate independent income. This initial exodus created the first notable decrease in conventional talent in the market and created new definitions of employment and “on-balance sheet” vs. “off-balance sheet” talent. Then, coming out of COVID-19, rapid changes in assistant technologies, hybrid work, and virtual collaboration made work more integrated into our personal lives. Work-life balance became an integrated component of our careers rather than an aspiration. It meant that the workforce was now empowered to select and choose work based on how work fits into their lives and the type of employment that worked best for them. This fundamental shift of empowerment turned the tables in Canada and put employers on notice that top talent will not be easy to find, it will not be easy to convert, it will not be easy to keep, and the traditional definitions of employment no longer bind it.

To compound the issue, Canada’s workforce is retiring faster than it is growing, and the primary source of labour force sustainment is immigration. Contrary to popular opinion, however, this unique dynamic is advantageous in an economic decline. To meet the decreasing employment needs, natural attrition, and tighter immigration requirements eventually balance against the financial need. This was highlighted by TD Bank when they analyzed the rising unemployment and participation rates in key economic sectors:

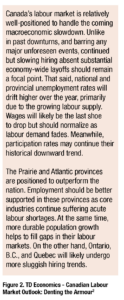

Canada’s labour market is relatively well-positioned to handle the coming macroeconomic slowdown. Unlike in past downturns, and barring any major unforeseen events, continued but slowing hiring absent substantial economy-wide layoffs should remain a focal point. That said, national and provincial unemployment rates will drift higher over the year, primarily due to the growing labour supply. Wages will likely be the last shoe to drop but should normalize as labour demand fades. Meanwhile, participation rates may continue their historical downward trend.

The Prairie and Atlantic provinces are positioned to outperform the nation. Employment should be better supported in these provinces as core industries continue suffering acute labour shortages. At the same time, more durable population growth helps to fill gaps in their labour markets. On the other hand, Ontario, B.C., and Quebec will likely undergo more sluggish hiring trends.

What’s the Future (WTF)?

This contracting labour market suddenly becomes worrisome if an optimistic view is applied. With a decreasing participation rate, contractions in immigration numbers, and an increasingly empowered workforce, organizations facing growth and economic advancement will potentially struggle to keep pace with the need for talent.

But…first and foremost, the need for talent differs from the need for labour. This critical distinction is why sometimes there are lineups for open house hiring events and then vacant positions that go unfilled for months:

The more the overlap between a Skills Shortage and a Labour shortage, the more critical the talent shortage becomes. This is the current state in provinces like Saskatchewan and some of the Atlantic provinces, where necessary skills in Mining and Healthcare are in short supply. At the same time, populations and general labour pools continue to decline, and migration from the regions continues to occur. This creates extreme unemployment and forces employers to rethink how they attract and retain key and general skills in their areas.

Employers across Canada have identified this talent shortage as a critical impairment to their business. A recent Statistics Canada survey identified the core sectors with ongoing skills shortages and geographic sentiment when understanding this new shift in the market. Highlighting the Talent shortage is the gap between organizations that reported a higher skill shortage but a lower impact in hiring. This indicated that the potential for labour to fill those skilled roles — and their availability — is in line with the market. However, when that gap decreases, the talent shortage becomes more critical, and the numbers become more closely aligned.

Numerous forecasts about the talent shortage impact Canadians and Canadian organizations. In 2022, CTV News collected key highlights from various institutions and government entities to capture the salient points employers need to be aware of. Some of those include:

- In the next 10 years, nine out of ten jobs will require digital skills,

- 56% of Canadian employers said their workforce is not proficient enough,

- 60% of organizations said they are already facing at least one negative outcome from the skills shortage,

- Canada is 10 points lower than the global average for digital skills readiness,

- Only 23% of workers feel prepared with digital skills for the next 5 years, and

- Yet only 14% are learning the digital skills needed.

What Can Organizations Do?

The broader Canadian talent shortage cannot be solved overnight, nor can employers solve it alone. Canada is a globally connected culture that relies on immigration, trade, and global policy to thrive. Additionally, Canada’s public system of government influences education, funding, and economic investment in key growth markets, which takes time and data to evolve. These significant factors must change for Canada to overcome its critical talent shortages; however, organizations cannot wait. Critical vacancies need to be filled today, productivity needs to be addressed immediately, and profitability needs to be sustained to fuel growth and performance.

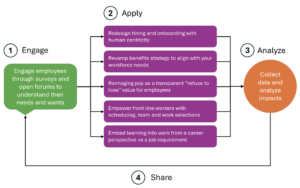

This means organizations must adapt to the realities of their markets and look at the available levers they can pull. Whether the company is a small local employer or an expanding multinational organization, engaging with the workforce is the first step in directly combating the talent shortage. This is followed by applying that workforce feedback to core areas such as talent attraction, talent management, total rewards, and learning. The output from that analysis will inevitably determine the wins and failures that result. Finally, sharing the output with employees openly and transparently will demonstrate the ongoing commitment and long-term partnerships between employers and employees.

- Engage: Engaging with the workforce to understand their expectations, whether through surveys, fireside chats, open emails, or simple lunch sessions, is a critical component to combating the talent shortage. By participating in their talent strategy, employees become invested in the outcome, share ownership, and commit to the results.

- Apply: Looking at several ways to apply employee feedback requires changing how organizations operate. These changes do not have to be executed at full scale, and often, pilot programs in recruiting, benefits, or scheduling create the safe spaces needed to learn before applying en masse.

- Analyze: Tracking and reviewing the data against the objective is key to determining what to scale, expand, and stop. Owning the failures is just as critical as the successes because the lessons learned from what did not work prevent repeats.

- Share: In the commitment to engage, employees must see how their ideas are being applied and what worked and did not work for them. Their ideas, small wins, and applications build longevity and retention, while the ideas that did not come to fruition are learnings for them as they weigh what is needed in their careers.

The Bottom Line

Canada is in the middle of a talent shortage. There are acute labour shortages and critical skills shortages in various industries and metropolitan areas. There are no easy answers or quick solutions to the problem without alignment between the government, education, and private sectors. Immigration remains the only source of labour force growth at scale to meet long-term economic demands. Still, Canada’s global readiness and attractiveness for the needed skills are lower than that of worldwide competition. Hybrid work and empowered employees will continue to be the norm for the near future. Inflection points are on the horizon as large-scale employers seek a return to office…potentially creating more flex in the talent market as employees push back, look for alternatives, and potentially embrace gig talent more openly.

Employers can act and apply practical strategies to engage their workforce despite the long-term challenges. If those engagements are followed by action and change in how employees are supported and developed, this will yield better retention, increased productivity, and higher competitive value in local markets. This broader change in how employers and employees collaborate on the talent strategy will produce more stability for organizational leaders and change how employees perceive their next future employer.

ENDNOTES

1 Figure 1. How COVID-19 has changed Canada’s economy for the worse — but also for the better | CBC News, https://bit.ly/3DhQ94V.

2 Figure 2. TD Economics – Canadian Labour Market Outlook: Denting the Armour, https://bit.ly/3ZLgoIO

3 Figure 3. Skills gaps and recruitment difficulties in Canada: Findings from the Survey of Employers on Workers’ Skills (statcan.gc.ca), https://bit.ly/3Di7mLH

Further Reading

Determinants of skill gaps in the workplace and recruitment difficulties in Canada (statcan.gc.ca)

Canada’s ‘skills gap’ problem explained | CTV News